Florida DMV Practice Test iOS

Accelerate your driver's license journey with Florida DMV Practice Test! Our app simulates the real DMV exam experience, providing you with a wide array of practice questions to prepare you for Florida's driving test with confidence. Each question comes with a comprehensive explanation, ensuring you're not just memorizing but deeply understanding the rules of the road.

Key Features:

Extensive Question Bank: Delve into a rich collection of practice questions, covering all vital topics to ensure you’re fully prepared for the Florida driving exam.

In-Depth Explanations: Benefit from detailed rationales accompanying every question, designed to clarify and solidify your understanding of Florida's driving laws and regulations.

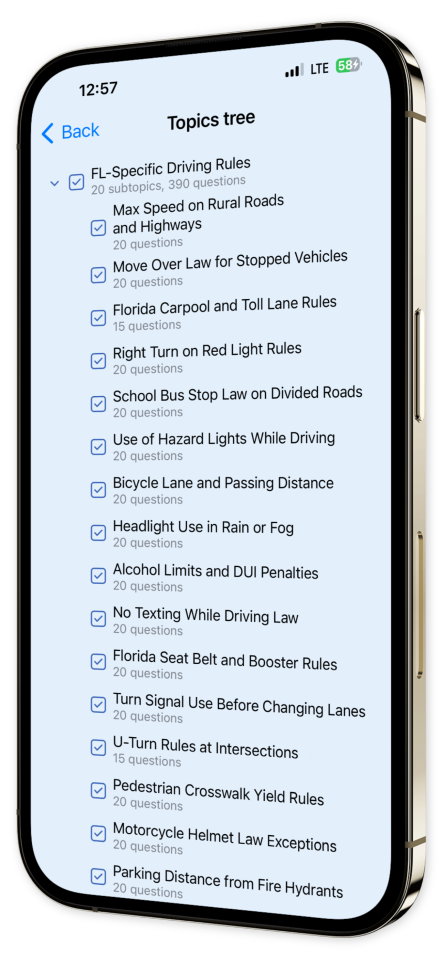

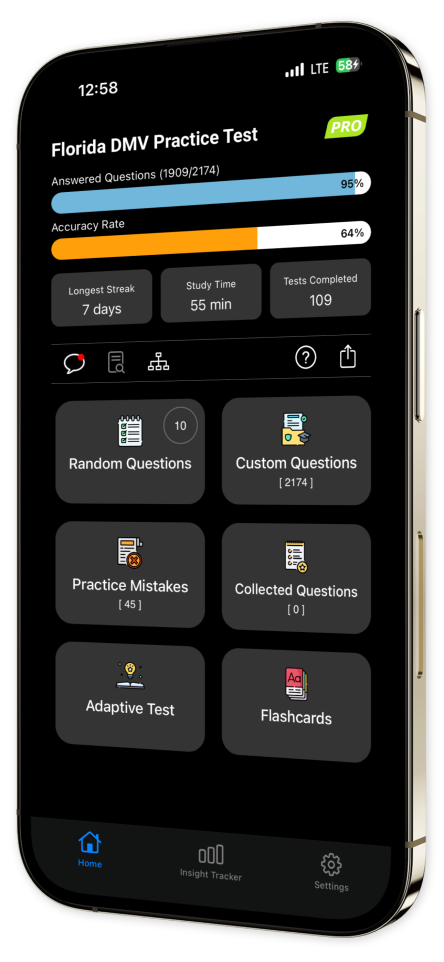

Customizable Quizzes: Customize your practice sessions by selecting specific subjects and question styles, enabling you to concentrate on the areas where you need the most reinforcement.

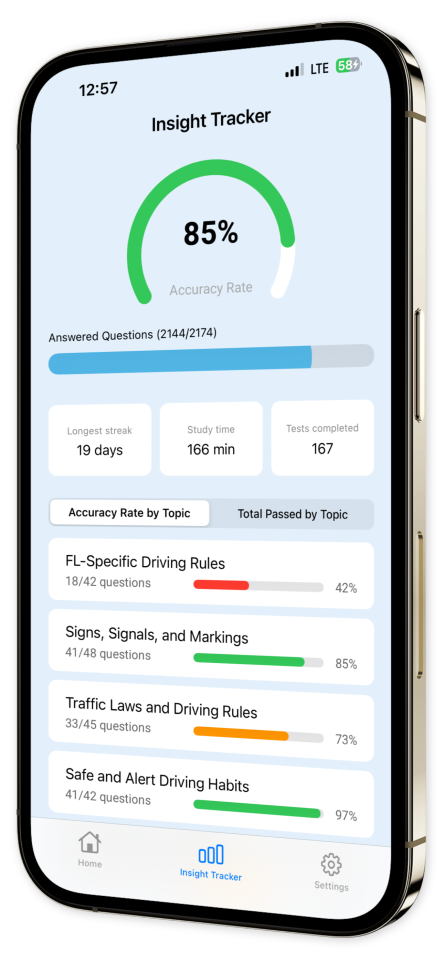

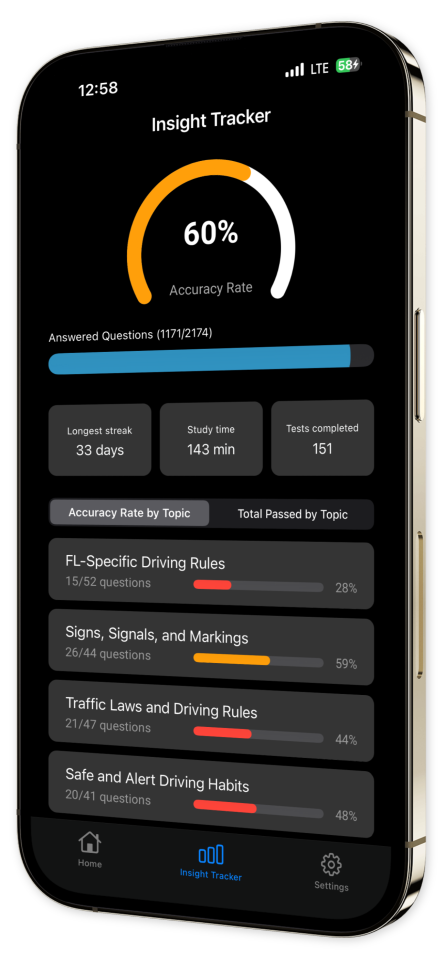

Progress Tracking: Monitor your advancements over time with our user-friendly progress tracking, offering insights into your readiness for exam day.

Offline Access: Study at your convenience with offline access, making it effortless to prepare anytime and anywhere, regardless of internet availability.

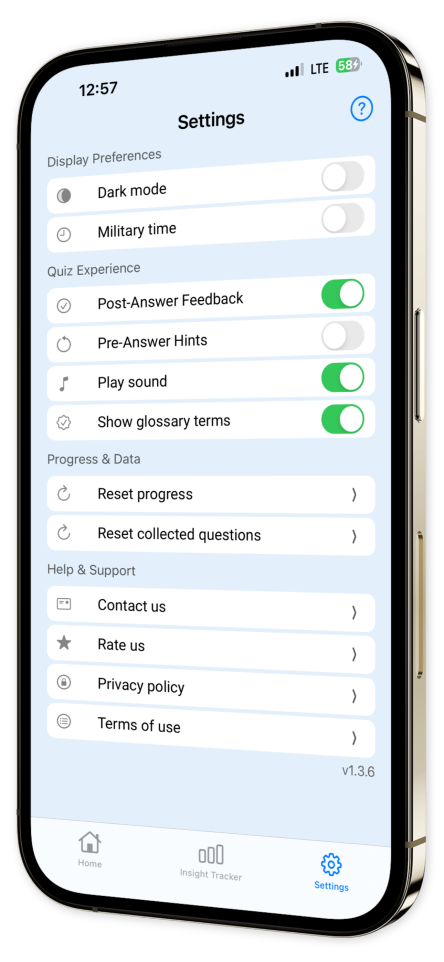

User-Friendly Interface: Navigate effortlessly through our intuitive app design, focusing all your attention on mastering the necessary knowledge and skills.

Download Florida DMV Practice Test today and embrace a smarter approach to becoming a confident, knowledgeable driver! Transform the way you prepare and drive your success in Florida’s DMV exam.

Prepare effectively, understand thoroughly, and succeed definitively. Your Florida driving license starts here!

Content Overview

Explore a variety of topics covered in the app.

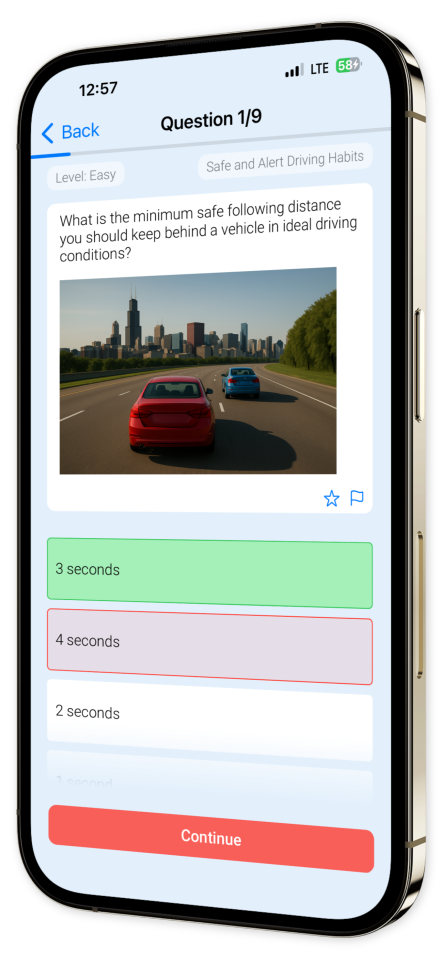

Example questions

Let's look at some sample questions

FL first question

Increases deduction limits to 70% of AGI for cash donationsReduces taxable income by a flat $300 for everyoneAllows 100% of AGI for deduction if donating cashRemoves deductions for non-itemizers

The CARES Act temporarily allows individuals to deduct cash contributions to public charities up to 100% of their AGI, lifting the usual 60% limit for the tax year.